We compare all the top forex brokers, providing the information and guidance you need to make the right decisions when it comes to spread betting. Our guide takes you through all the key criteria you need to know when picking the best account to spread bet the forex market, with a focus on regulation, design, and spreads. To get more news about forex brokers for spread betting, you can visit wikifx.com official website.

We love eToro because it’s a great trading platform for beginners, with an interface that’s easy to use via app or desktop. A safe and trustworthy broker used by millions of traders worldwide, eToro boasts a zero-to-low fee structure that won’t gobble up your money in charges.

There are more than 5,000 crypto, stock, etf, forex, and commodity assets available to trade on eToro. You can dive straight in to trade or dip your toe in gently with one of the best demo accounts in the business. We like to switch to virtual mode and use its unique CopyTrader feature to get trade ideas, test out strategies, and learn from the pros.

The fees: All stock and ETF trading is commission fee. All crypto trades are charged a 1% fee. Currency spreads are 1 pip, for commodities it’s 2 pips. Stock CFDs have a 0.15% spread. All deposits are free, withdrawals cost $5. There’s an inactivity fee of $10 per month that kicks in if you don’t log in to your account for 12 months.

We love Public because it’s a social platform where you can share trading tips and get ideas from other people. Public offers 9,000+ financial instruments, including cryptocurrencies and stocks from around the world.

Alongside a community of other investors all sharing their ideas, Public offers real time news and information so that you can see the full picture before you invest. And the assets don’t just include your run-of-the-mill assets; you can make alternative investments in things like handbags and comic books as well.

The fees: There are no fees for investing in stocks during regular trading hours in the US – 9.30am-4pm EST. There is a $2.99 fee for trades outside of regular hours. Alternative investments, including cryptocurrency, are charged a 2.5% fee per transaction.

Forex spread betting platforms are companies that provide retail traders with access to online platforms that allow them to bet on the price movement of currency pairs. The best forex platforms are easy to use, well regulated, and carry strong reputations acquired through years of steady operation and stellar customer service.

How do forex spread betting brokers work?

These platforms enable clients to bet on the price of assets online or via a mobile app. Simply open your account, deposit funds, and you can start spread betting on the forex markets.

A broker offering usually provides two price quotes for a currency pair, the bid and the ask. The gap between the bid price and the ask price is called ‘the spread’. Traders bet on whether the price of the currency pair will be lower than the bid price, or higher than the ask price.

For spread bettors, the narrower the spread is, the more attractive the currency pair becomes. That’s because narrower spreads mean lower transaction costs for those wanting to enter and exit a trade.

Let’s use an example to illustrate how it works when you place a forex spread bet on a currency pair:

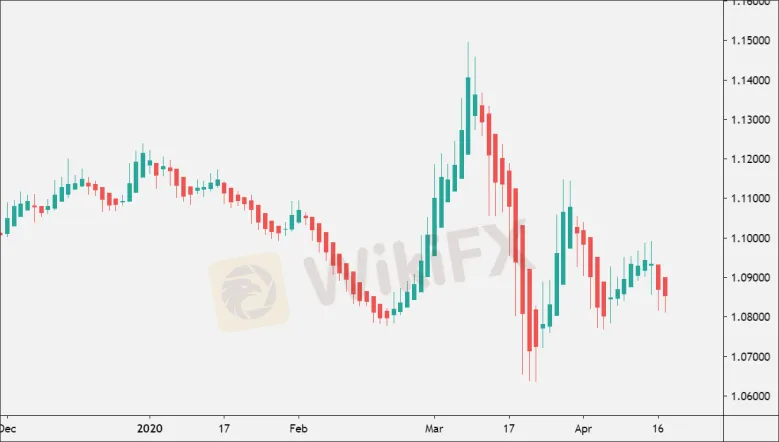

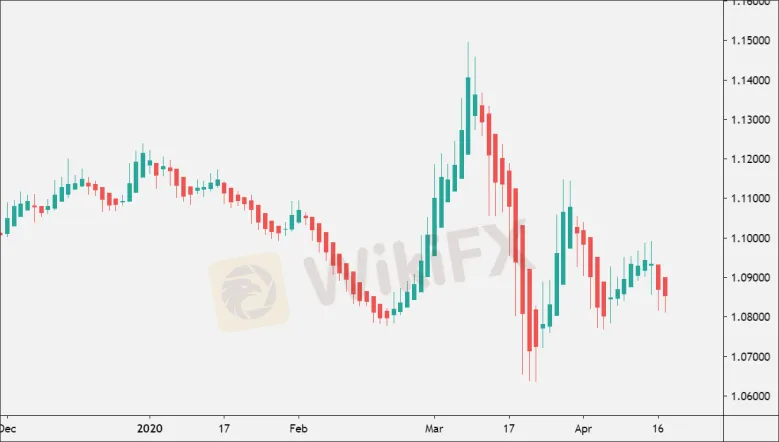

Say a broker quotes you an ask price of 1.1155 on the EUR/USD (Euro/U.S. Dollar) pair, with a bid price of 1.1150. If you think the Euro will strengthen compared to the Dollar, you could bet €0.5 for every point (also known as a “pip”) the euro rises above 1.1155.

|

コメント

コメント:0件

コメントはまだありません